Saudi Arabia Retail Banking Market Overview

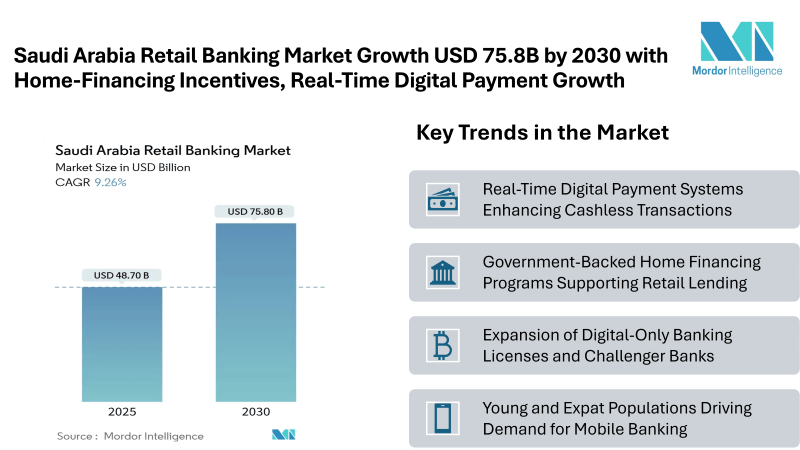

According to Mordor Intelligence, the Saudi Arabia retail banking market size stands at USD 48.7 billion in 2025 and is forecast to reach USD 75.8 billion by 2030, advancing at a 9.26% CAGR. Online banking is becoming an increasingly significant part of retail transactions, while Islamic finance continues to play a major role in total banking assets.

The Saudi Arabia Retail Banking Market share is influenced by a mix of traditional national banks and emerging digital-first neobanks that attract younger and expatriate customers.

Key Trends in the Saudi Arabia Retail Banking Market

Government-Backed Home Financing Programs Supporting Retail Lending

National housing mortgage initiatives are enabling more citizens to access home financing, helping banks grow residential lending and reach a wider retail base.

Real-Time Digital Payment Systems Enhancing Cashless Transactions

Instant payment platforms are accelerating retail banking, making transactions faster and more convenient, promoting fintech partnerships, and reducing reliance on cash-based payments.

Expansion of Digital-Only Banking Licenses and Challenger Banks

Licensing of neobanks and digital-only banks is increasing retail banking competition, offering easy account setup, mobile-first services, and innovative solutions for tech-savvy customers.

Young and Expat Populations Driving Demand for Mobile Banking

The expanding youth and expatriate population increasingly use digital banking, prompting banks to offer tailored products, loyalty programs, and mobile solutions for engagement.

Check out more details and stay updated with the latest industry trends, including the Japanese version for localized insights: https://www.mordorintelligence.com/ja/industry-reports/saudi-arabia-retail-banking-market?utm_source=emailwire

Segmentation of the Saudi Arabia Retail Banking Market

- By Product:

- Transactional Accounts

- Savings Accounts

- Debit Cards

- Credit Cards

- Loans

- Other Products

- By Channel:

- Online Banking

- Offline Banking

- By Customer Age Group:

- 18–28 Years

- 29–44 Years

- 45–59 Years

- 60 Years and Above

- By Bank Type:

- National Banks

- Regional Banks

- Neobanks & Others

Explore Our Full Library of Financial Services and Investment Intelligence Research Reports – https://www.mordorintelligence.com/market-analysis/financial-services-and-investment-intelligence?utm_source=emailwire

Key Players in the Saudi Arabia Retail Banking Market

- Saudi National Bank: The largest bank in Saudi Arabia, offering a comprehensive range of retail banking services and digital solutions to individual and corporate clients.

- Al Rajhi Bank: A leading Sharia-compliant bank, providing extensive retail and mortgage financing along with innovative digital banking services.

- STC Bank: A digital-first bank focusing on mobile banking solutions and tech-driven services for younger and tech-savvy customers.

- Riyad Bank: Offers a wide portfolio of retail banking products, including personal loans, credit cards, and online banking services.

- D360 Bank: A neobank providing Sharia-compliant digital banking solutions, targeting expatriates and underserved retail segments.

Explore more insights on Saudi Arabia Retail Banking Market competitive landscape: https://www.mordorintelligence.com/industry-reports/saudi-arabia-retail-banking-market/companies?utm_source=emailwire

Conclusion

The Saudi Arabia Retail Banking Market is poised for sustained growth through 2030, driven by digital banking adoption, supportive government programs, and a youthful, tech-oriented customer base. Online banking continues to expand, reshaping how consumers interact with financial institutions.

Get the latest industry insights on the Saudi Arabia Retail Banking Market: https://www.mordorintelligence.com/industry-reports/saudi-arabia-retail-banking-market?utm_source=emailwire

Industry Related Reports

Saudi Arabia Fintech Market

The Saudi Arabia Fintech Market is projected to grow from USD 2.85 billion in 2025 to USD 5.28 billion by 2030, registering a CAGR of 13.08%. Growth is driven by increasing digital payment adoption and supportive government initiatives under Vision 2030, fostering innovation in mobile banking, digital lending, and payment solutions.

Get more insights: https://www.mordorintelligence.com/industry-reports/saudi-arabia-fintech-market?utm_source=emailwire

Saudi Arabia Gift Card And Incentive Card Market

The Saudi Arabia Gift Card And Incentive Card Market is expected to grow from USD 10.48 billion in 2025 to USD 16.89 billion by 2030, at a CAGR of 10.02%. Growth is fueled by rising corporate reward programs and increasing consumer preference for prepaid and digital gift cards, driving adoption across retail and e-commerce sectors.

Get more insights: https://www.mordorintelligence.com/industry-reports/saudi-arabia-gift-card-and-incentive-card-market?utm_source=emailwire

Middle East Islamic Finance Market

The Middle East Islamic Finance Market is projected to grow from USD 4.42 trillion in 2025 to USD 7.31 trillion by 2030, at a CAGR of 10.56%. Growth is supported by increasing demand for Sharia-compliant banking products and the expansion of Sukuk and Islamic investment instruments across retail and corporate sectors.

Get more insights: https://www.mordorintelligence.com/industry-reports/middle-east-islamic-finance-market?utm_source=emailwire

About Mordor Intelligence:

Mordor Intelligence is a trusted partner for businesses seeking comprehensive and actionable market intelligence. Our global reach, expert team, and tailored solutions empower organizations and individuals to make informed decisions, navigate complex markets, and achieve their strategic goals.

With a team of over 550 domain experts and on-ground specialists spanning 150+ countries, Mordor Intelligence possesses a unique understanding of the global business landscape. This expertise translates into comprehensive syndicated and custom research reports covering a wide spectrum of industries, including aerospace & defense, agriculture, animal nutrition and wellness, automation, automotive, chemicals & materials, consumer goods & services, electronics, energy & power, financial services, food & beverages, healthcare, hospitality & tourism, information & communications technology, investment opportunities, and logistics.

For any inquiries or to access the full report, please contact:

media@mordorintelligence.com

https://www.mordorintelligence.com/

Mordor Intelligence, 11th Floor, Rajapushpa Summit, Nanakramguda Rd, Financial District, Gachibowli, Hyderabad, Telangana – 500032, India.